Are You Planning To Start A Small Or Medium-Sized Business?

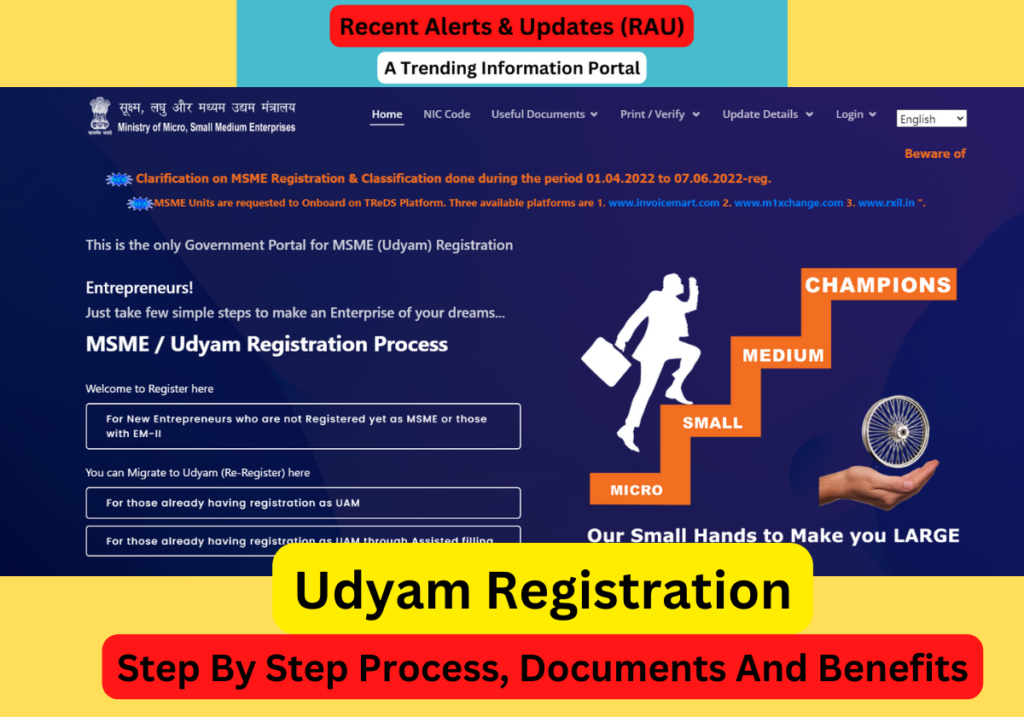

With The Launch Of The Udyam Registration Portal, The Indian Government Is Taking Care Of You.

This Online Platform Is Made To Help MSME Entrepreneurs Like You Register Your Business And Get Access To A Lot Of Benefits And Opportunities.

Here, We’ll Go Into Detail About How Udyam Registration Works And How Registering Your MSME Can Help You Get A Lot Of Benefits.

So, Sit Back And Get Ready To Learn Everything You Need To Know About The Udyam Registration And How It Can Help Your Business Grow.

Udyam Registration: An Introduction To The Process

The Government Of India Has Made It Easier For Small And Medium-Sized Businesses (MSMEs) To Register And Get The Benefits That Come With Udyam Registration, The Old, Complicated Udyog Aadhar Process Has Been Replaced By An Online System.

Udyam Registration Is An E-Certification That Gives Small And Medium-Sized Enterprises (MSMEs) A Unique Identification Number And A Certificate Of Recognition.

This Certificate Proves That Your Business Is A Micro, Small, Or Medium-Sized Enterprise (MSME) And Gives You Access To A Wide Range Of Benefits Just For Businesses Like Yours.

Eligibility Criteria For Udyam Registration

- Enterprises Must Fall Into One Of Three Categories: Micro, Small, Or Medium

- Benefits For MSME’s Are Based On Their Total Turnover:

- Micro Enterprises (Turnover Up To Inr 5 Crore) Are Eligible For Registration And Benefits

- Small Enterprises (Annual Turnover From Inr 5 Crore To Inr 75 Crore) Are Eligible For Benefits

- Medium Enterprises (Annual Turnover Up To Inr 250 Crore) Are Eligible For Benefits

- Investment In MSME’s Is Also Considered:

- Micro Enterprises Must Have An Investment Of No More Than Inr 1 Crore To Be Eligible For Benefits And Registration

- Small Enterprises Must Have An Investment Of No More Than Inr 10 Crore To Be Eligible

- Medium Enterprises Must Have An Investment Of No More Than Inr 50 Crore To Be Eligible

| MSME Category | Annual Turnover (INR) | Investment (INR) |

|---|---|---|

| Micro Enterprise | 5 crore | Upto 1 crore |

| Small Enterprise | 5 crore-75 crore | Upto 10 crore |

| Medium Enterprise | 25 crore- 250 crore | Upto 50 crore |

Benefits Details Of Udyam Registration For MSME’s

| Benefits | Description |

|---|---|

| Collateral Free Loans | Access to loans from banks and financial institutions without collateral |

| Multiple Registrations and Licenses | Easy access to multiple registrations and licenses |

| Concession Rates on Utility Bills | Concession rates on electricity bills and other utilities |

| Delayed Payment Time | More time for paying off delayed payments |

| Subsidy and Low Interest Rates on Bank Loans | Subsidy and low interest rates offered on bank loans |

| Subsidy on Patents and Barcodes | Subsidy offered on patents and barcodes |

| Subsidy on Credit Rating | Subsidy on credit rating |

| Tax Exemptions | Special exemptions under all kinds of direct taxes |

| ISO Certification Reimbursement | Reimbursement of ISO certification charges |

How To Apply For Udyam Registration?

| Step | Instruction |

|---|---|

| 1 | Visit the Udyam Registration official website. |

| 2 | Click “for new entrepreneurs who are not registered yet as MSME”. |

| 3 | Enter your Aadhaar number and then enter the OTP received on your registered mobile number. |

| 4 | Click on the “validate” tab to successfully validate the Aadhaar number. |

| 5 | Validate the PAN card. Enter the enterprise type and PAN number. |

| 6 | Fill the MSME registration form with all necessary details. |

| 7 | File the form and agree on terms and policies. |

| 8 | Submit the form and enter the OTP. |

| 9 | Receive the e-registration certificate on your mail ID. |

| 10 | Verify the validity of Udyam Registration by visiting the verification link. |

The Benefits of Udyam Registration

| Key Features | Details |

|---|---|

| Permanent registration number | Once registration is done, you will be provided with a permanent registration number. |

| Online registration certificate | The registration certificate will be issued online. |

| No renewal requirement | There is no requirement for renewal of registration. |

| Zero charges and paperwork | Registration process has no charges with zero paperwork. |

| Integrated with income tax and GST | Udyam portal is integrated with income tax and GST identification systems. |

| Single registration per enterprise | No enterprise can file more than one registration. |

What Are The Documents Required For Udyam Registration?

| Document | Description |

|---|---|

| PAN details of the enterprise | PAN details of the MSME |

| Aadhaar card | Aadhaar card of the MSME owner |

| Registered mobile number | Registered mobile number for communication |

| GST certificate and copy of passbook | GST certificate and copy of bank passbook |

| List of male and female employees | List of male and female employees of the MSME |

| Audit details or financial statement of the business | Financial statement of the business or audit details |

| Partnership deed, if any | Partnership deed, if the MSME is a partnership firm |

| Articles of association | Articles of association of the MSME |

| Memorandum of association | Memorandum of association of the MSME |

Last Notes For Udyam Registration

Starting A Small Business Is A Big Step In Anyone’s Life, But With Udyam Registration, The Process Has Gotten A Lot Easier.

This Self-Declaration Platform Is Paperless, Free, And Specifically Designed To Make The Process Of Registering Your Business As Simple And Straightforward As Possible.

As An MSME Entrepreneur, You Can Now Easily Register Your Business Without The Hassle Of Paper-Based Processes Or Expensive Fees.

You Can Take Advantage Of The Numerous Benefits That Come With Being A Part Of India’s Thriving MSME Community By Registering With Udyam.

Udyam Registration Not Only Makes It Easier For You To Register Your Business, But It Also Assists The Government In Keeping Track Of The Number Of MSMEs In India.

Authorities Can Gain A Better Understanding Of The Products And Services Offered By MSMEs, As Well As The Size Of The Enterprises, Investment, And Turnover, With This Information.

So, Why Wait If You’re An MSME Entrepreneur? Use Udyam Registration Today To Join The Growing Number Of Small Business Owners Reaping The Benefits Of This Innovative And Convenient Platform. Your Future Success Is Only A Few Simple Steps Away.

What is Udyam Registration?

Udyam Registration is an e-certification provided by the Indian government for small and medium-sized businesses (MSMEs). It provides a unique identification number and certificate of recognition for MSMEs.

Who is eligible for Udyam Registration?

MSMEs that fall into one of the three categories: Micro, Small, or Medium and have an investment and total turnover within the specified limits are eligible for Udyam Registration.

What are the benefits of Udyam Registration?

The benefits of Udyam Registration include collateral-free loans, concession rates on utility bills, low interest rates on bank loans, subsidies on patents and barcodes, tax exemptions, and reimbursement of ISO certification charges.

How to apply for Udyam Registration?

Steps for Udyam Registration are: visiting the official website, entering the Aadhaar number and PAN details, filling the MSME registration form, submitting the form and receiving the e-registration certificate.

What are the key features of Udyam Registration?

The key features of Udyam Registration include permanent registration number, online registration certificate, no renewal requirement, zero charges and paperwork, integration with income tax and GST, and single registration per enterprise.

What are the documents required for Udyam Registration?

The documents required for Udyam Registration include PAN details, Aadhaar card, registered mobile number, GST certificate and passbook, list of employees, financial statement or audit details, partnership deed (if applicable), articles of association, and memorandum of association.

Is Udyam Registration a paperless process?

Yes, Udyam Registration is a paperless, self-declaration platform designed to make the registration process easier for MSMEs.

| Udyam Registration official website | CLICK HERE |

| Recent Alerts & Updates (Rau) | CLICK HERE |